How Can Peer Pressure Impact Your Spending Habits

When it comes to buying and consumer behavior it is always perceived that good or bad the peer pressure imposes an impact which is in the best use of marketers. Practicing these while they are young could set your students up for a lifetime of healthy spending habits and better navigating peer pressure.

Determinants Of Students Spending Habits A Case Study Of Students At A Premier University Of African Scholarship Document Gale Academic Onefile

We can share and discuss these with our students.

. When it comes to finances there is some positive peer pressure. Keep focused on the future to fight pressure. This kind of peer pressure can be especially difficult for folks trying to pay down credit card debt or save for the future.

Its even more accurate as it relates to the way you spend your money. Your peers give the best influence or the worst influence. Study habits are the approach on how school works are done and how students budget their time in doing tasks.

Peer pressure can cause you to. Here are five ways our family and friends influence our spending and how we can stop it from happening. Despite its drop-in popularity cash is still king.

According to a new study peer pressure has the power to weaken our resolve significantly and even prompt us to buy things that we have no initial interest in purchasing. To resist financial peer pressure you have to know what you can handle. You dont have to say yes to every invitation.

Peer pressure forces young adults to spend says report. Ultimately the influence social media has on your spending habits will be unique to you. Friends that respect you and your goals are the ones worth hanging out with in the first place.

Millennials influenced by friends spending habits. During a weak economy jobs are scarce so some individuals may consider starting their own businesses. How can we help our students deal with situations that pull at both their friendships and at their wallets.

If hitting the mall. This in turn impacts your ability to save and invest for future needs. We often think that we have far more control over our actions than we really do.

It is true that most of the teens start spending more time with their friends and are influenced by these peers through peer pressure same time the parents need to remember one simple truth. Fix Your Mind on the Future. Select the best answer below make impulse purchases and spend beyond your means.

Time is really on your side and it can do fabulous things for you if. Plan on sticking to your budget. Although friends can often be persuasive and some will try to link their friendship to your ability to spend alongside them you are the one to blame for over-spending.

It can make a student strive for academic success because of their peers or it can improve the study habits of students. Therefore set yourself some limits and stay bound to them. What is a disadvantage of this idea.

This in turn impacts your ability to save and invest for future needs. The study by Pedro. Social media users are spending beyond their means to get positive feedback from their followers.

This in turn impacts your ability to create a budget because you never know how much money will need to spend when you go out with your friends. If social media gives you attention that boosts your ego you will seek out more of that positive reinforcement by any means necessary. Peer pressure can cause you to.

5 ways to overcome spending peer pressure. Its a quote that has had a lot of longevity because it accurately describes the way the people around you can influence your behavior and your success. Consider other ways that your college peers can influence your spending behavior and dont succumb.

Some people exceed their budget and dig a hole for themselves because they want to appear better off than they actually are. Allianz argues peer pressure on social media is part of the problem. Good friends will understand that you have your limits.

Consider the benefits gained by saying no to the peer pressure to dine out or splurge a few times a week. How can peer pressure impact spending habits. All of these can have an impact on your finances and in your ultimate ability to finish your classes with good grades.

Theres an old saying show me your friends and Ill show you your future. Parents are part of the problem. Time is really on your side and it can do fabulous things for you if.

How can peer pressure impact your spending habits make impulse purchases and spend beyond your means. The study habits of students are highly affected by peer pressure. Moreover theres no shame in watching your spending.

If youve ever felt pressured into spending money whether it was on a new car you couldnt actually afford or a pricy group outing that blew your budget youve experienced financial peer pressure firsthand. You cant control what your friends do or buy but you can control who you shop with. To fight pressure keep your mind fixed on.

Your teen will never forget the values you have given himher. How can peer pressure impact your spending habits. It is important for young people to learn good spending and budgeting habits to stop them getting into a spiral of debt.

Take only cash with you. You have priorities and goals. You know you should have an IRA or 401k.

You know you should save more than you spend and you know. Here are 5 tips that have worked for others. Parents are part of the problem.

The study which examined social medias impact on American. Peer Pressure Affects Your Decisions And Purchases More Than You Think. At the same.

In fact an American study found that when people saw that they were outpacing their peers on spending they reduced their spending significantly. Make impulse purchases and spend beyond your means. Hence Peer pressure can lead to make the right choices in life thus can have a positive impact which might enable to change the perception towards being positive as well.

Have bad study habits that can cause them to fall behind in coursework. Millennials influenced by friends spending habits. Are you giving into peer pressure spending.

Just know that giving into spending peer pressure is one of the fastest ways to derail money-related goals. However if you already indulge in retail. Those in the lowest income group in the study were particularly swayed when they saw their spending was a lot higher compared to others reducing their spending for the month by 19 on average.

Make necessary purchases and spend beyond your means.

Pdf Spending And Saving Habits Of Youth In The City Of Indore Rekha Attri Academia Edu

Pin On Maps Charts Graphs Lessons

Nonfiction Books How To Save And Invest 14 A Smart Kid S Guide To Personal Finance Investing Smart Kids Personal Finance

Pdf Determinants Of Students Spending Habits A Case Study Of Students At A Premier University Of African Scholarship

How To Deal With The Peer Pressure To Spend More Money Lesson Ideas

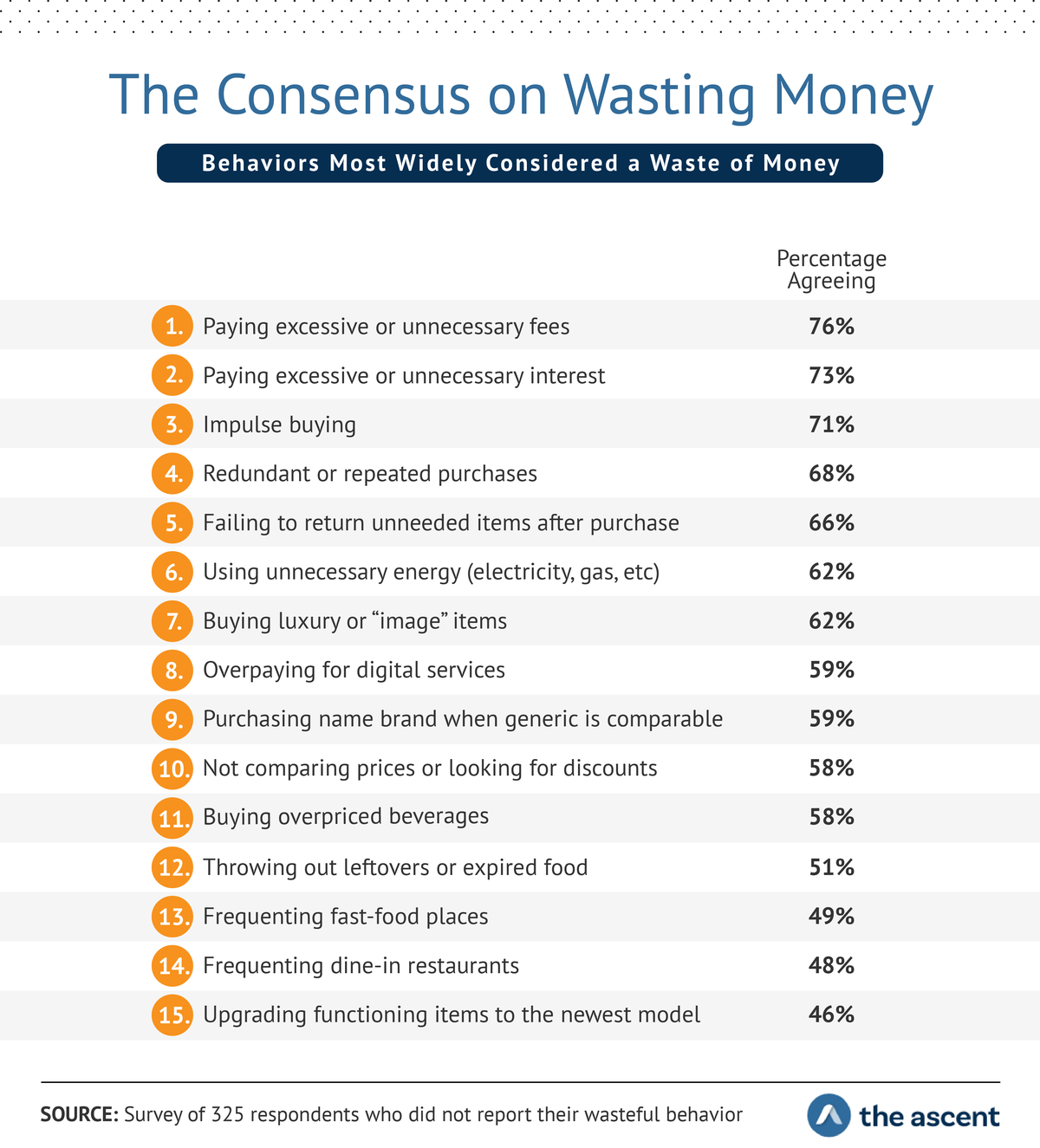

Study The Most Wasteful Spending Habits Among Americans

Pdf A Family Financial Management A Study Of Spending Habits Of Bank Employees Skirec Publication Ugc Approved Journals Academia Edu

5 Steps To Prepare For A Successful No Spend Challenge Tracker Guide Greatest Worth No Spend Challenge Money Saving Tips Saving Money

Pin On Quotes About Wealth Money

Participants Needed For Online Survey Topic Financial Literacy Knowledge Attitudes Toward Money Am Experiential Marketing Online Surveys Consumer Behaviour

Pdf Saving Habits Of Graduates

Consumer Challenge Identify Factors That Influence Consumer Choices Decide Steps Wise Consumers Take When Making Purchases Terms To Learn Consumer Ppt Download

The 7 Habits Of Highly Effective Teens By Sean Covey Http Www Amazon Com Dp B00geeb244 Ref Cm Sw R Pi Dp Shymtb190xfnh Books For Teens Sean Covey Good Books

7 Ways Social Media Influences Our Spending Habits Top Dollar

Pdf Financial Literacy And Spending Habits Of Bachelor Of Science In Accounting Information System Bsais Students

Comments

Post a Comment